US Trade Deficit: Analyzing Figures & Impact on Industries

The US trade deficit reflects the difference between the value of goods and services the US imports versus what it exports; recent figures reveal ongoing trends and significant implications for domestic industries striving to compete in a global market.

Understanding the **US trade deficit** is crucial for assessing the economic health of the nation and its impact on domestic industries. This article analyzes the latest figures and explores the implications for businesses operating within the US.

Understanding the US Trade Deficit: An Overview

The trade deficit is a fundamental concept in international economics. It essentially represents the difference between a country’s imports and exports. When a nation imports more goods and services than it exports, it runs a trade deficit. This imbalance has significant implications for everything from domestic job markets to currency values.

Analyzing the US trade deficit involves more than just looking at the numbers. It requires understanding the factors driving this deficit, and exploring the potential consequences for various sectors of the American economy.

Key Components of the Trade Deficit

Several elements contribute to the trade deficit. Understanding these can give you insight into the broader economic trends affecting the US.

- Goods vs. Services: The trade deficit is often discussed in terms of goods (physical products) and services (intangible activities). The US typically runs a trade deficit in goods and a trade surplus in services.

- Major Trading Partners: The US has significant trade relationships with countries like China, Canada, Mexico, and Japan. Trade imbalances with these partners contribute substantially to the overall deficit.

- Consumer Demand: Strong consumer demand within the US often drives imports, contributing to the expansion of the trade deficit.

These components interact in complex ways, influencing the overall trajectory of the trade deficit and its impact on the US economy.

In conclusion, understanding the US trade deficit requires a comprehensive analysis of its key components and their interplay. This understanding is crucial for policymakers and businesses alike, as they navigate the challenges and opportunities presented by global trade dynamics.

Latest Figures: A Detailed Analysis

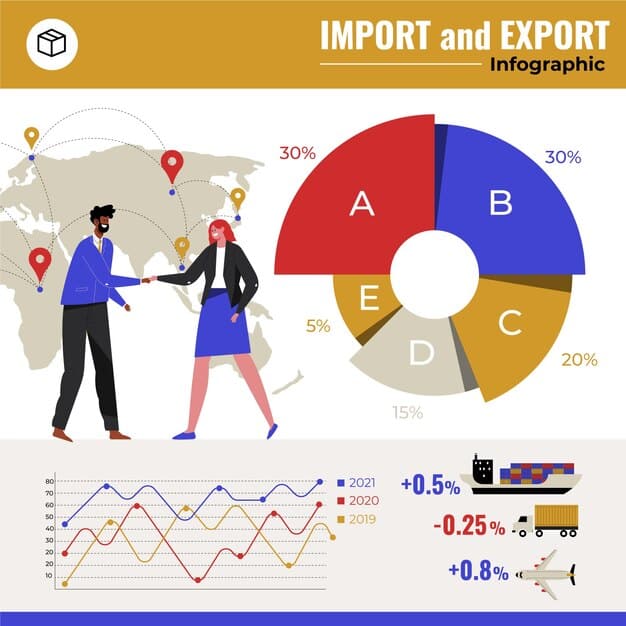

Recent data on the US trade deficit provides invaluable insights into the current economic landscape. These figures help us understand not just the size of the deficit, but also the specific sectors and trading partners that contribute most significantly.

Examining this data is important for identifying trends, assessing the effectiveness of trade policies, and forecasting future economic performance.

Key Trends in Recent Trade Data

Analyzing the latest trade figures reveals several important trends in the US economy.

- Increased Imports: Imports have been steadily increasing due to strong domestic demand and a relatively strong dollar.

- Fluctuating Exports: Exports have faced challenges due to global economic conditions and trade tensions with key partners.

- Sectoral Imbalances: Certain sectors, like electronics and automobiles, contribute significantly to the trade deficit.

These trends highlight the complex dynamics shaping the US trade picture and underscore the need for strategic policy responses.

By examining the latest figures and understanding the key trends, we can gain a deeper understanding of the factors influencing the US trade deficit and its implications for domestic industries.

The Impact on Domestic Industries: An Overview

The US trade deficit has broad and varied effects on domestic industries. Certain sectors struggle with competition from imports, while others benefit from access to foreign markets. Understanding these diverse effects is critical for developing targeted policies and strategies.

This is important for industries to adapt and thrive in an ever-changing global trade environment.

Winners and Losers in the Trade Deficit

The trade deficit creates winners and losers throughout the US economy.

- Manufacturing: Domestic manufacturers often face stiff competition from cheaper imports, leading to job losses and reduced production.

- Agriculture: Agricultural exports can be affected by trade barriers and currency fluctuations, impacting farm incomes and rural economies.

- Technology: Some tech companies benefit from access to global supply chains and export markets, while others face competition from foreign firms.

By understanding which industries are most affected, policymakers can implement measures to support struggling sectors and promote overall economic growth.

Understanding these effects helps domestic businesses navigate the challenges and opportunities presented by the trade deficit, promoting long-term growth and competitiveness.

Policy Responses to the Trade Deficit

The size and persistence of the US trade deficit have prompted various policy responses from government officials and economists. These policies aim to address the root causes of the deficit and mitigate its potential negative effects on the economy.

Exploring these policies is important for evaluating their effectiveness and considering alternative approaches.

Strategies for Reducing the Trade Deficit

Several policy measures have been proposed and implemented to reduce the trade deficit.

- Trade Agreements: Negotiating new trade agreements or revising existing ones to reduce trade barriers and promote exports.

- Currency Manipulation: Addressing currency manipulation by trading partners to ensure fair exchange rates.

- Infrastructure Investment: Investing in domestic infrastructure to improve competitiveness and reduce reliance on imports.

These strategies require careful consideration of their potential impacts on different sectors and their overall effectiveness in achieving desired outcomes.

Evaluating policy responses helps to understand their potential impact and effectiveness in promoting a more balanced and sustainable trade relationship.

The Role of Currency Valuation

Currency valuation plays a pivotal role in shaping trade dynamics. The relative value of the US dollar against other currencies can significantly influence the competitiveness of American exports and the cost of imports.

Understanding this is important for evaluating the trade deficit and its potential effects on the economy.

How Currency Valuation Impacts Trade

Currency valuation can have significant effects on trade flows.

- Strong Dollar: A strong dollar makes US exports more expensive for foreign buyers, reducing demand, and makes imports cheaper for US consumers, increasing demand.

- Weak Dollar: A weak dollar makes US exports more competitive and reduces the cost of imports, potentially narrowing the trade deficit.

- Exchange Rate Policies: Governments can influence exchange rates through various policies, affecting the competitiveness of their exports.

Understanding these dynamics is crucial for businesses and policymakers as they navigate the complexities of international trade.

By understanding the role of currency valuation, policymakers and businesses can better assess the trade deficit and its implications for the US economy.

Future Outlook and Potential Scenarios

Looking ahead, the US trade deficit will likely remain a significant feature of the global economic landscape. Various factors, including technological innovation, global economic growth, and policy decisions, will shape its future trajectory.

Forecasting these is important for businesses and policymakers to prepare for future challenges and opportunities.

Factors Influencing Future Trade Dynamics

Several factors will influence the future of the US trade deficit.

- Technological Advancements: Automation and digital technologies could reshape global supply chains and trade patterns.

- Geopolitical Developments: Trade tensions, political instability, and geopolitical events can disrupt trade flows and create new challenges.

- Policy Changes: Shifts in trade policy, such as new tariffs or trade agreements, can significantly alter the trade landscape.

By considering these potential scenarios, stakeholders can better navigate the uncertainties and plan for the future.

Understanding these factors helps to anticipate potential changes and prepare for future challenges and opportunities in the global economy.

| Key Aspect | Brief Description |

|---|---|

| 📊 Definition | Difference between US imports and exports. |

| 📈 Recent Trends | Increasing imports due to demand and fluctuating exports. |

| 💼 Impact Sectors | Affects manufacturing, agriculture, & technology diversely. |

| 💰 Policy Responses | Trade agreements, currency measures, infrastructure investments. |

What is the US trade deficit?

The US trade deficit occurs when the value of goods and services that the United States imports exceeds the value of its exports. This imbalance indicates that the country is purchasing more from abroad than it is selling.

Strong domestic demand, particularly for consumer goods, often fuels imports. Fluctuations in currency values and the relative competitiveness of US industries also play significant roles in shaping the trade balance.

The trade deficit can challenge domestic manufacturers who face competition from cheaper imports. Agricultural exports can also be affected by global trade dynamics, influencing farm incomes and the broader rural economy.

Trade agreements aimed at lowering barriers, infrastructure investments to boost competitiveness, and measures against currency manipulation are several policy tools used to address trade imbalances and promote a level playing field.

The future trade deficit will depend on many factors, including technological advancements, policy changes, and geopolitical stability. These will require adaptation and strategic planning for stakeholders navigating the global economy.

Conclusion

In summary, the **US trade deficit: analyzing the latest figures and their implications for domestic industries** reveals a complex interaction of economic forces. Understanding the trade deficit’s key components, impacts, and applicable policies is crucial for informed decision-making and fostering a balanced and sustainable economic future. The ongoing monitoring and strategic adaptation remain essential for navigating the ever-evolving landscape of global trade.